Emilyvuong

No content yet

emilyvuong

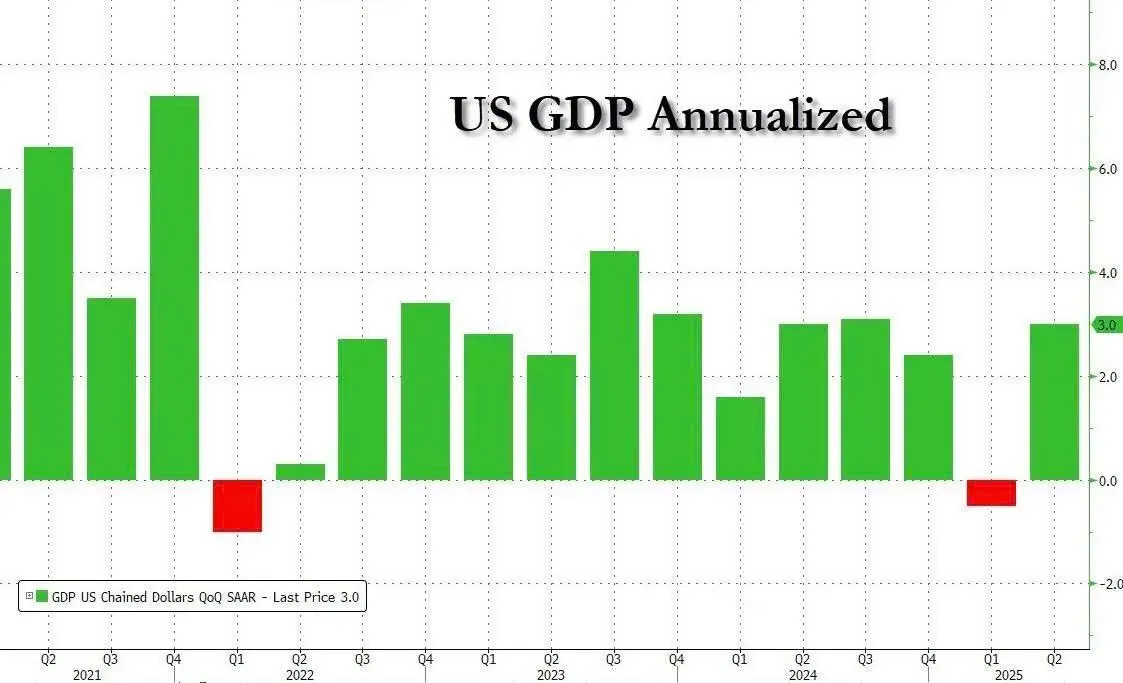

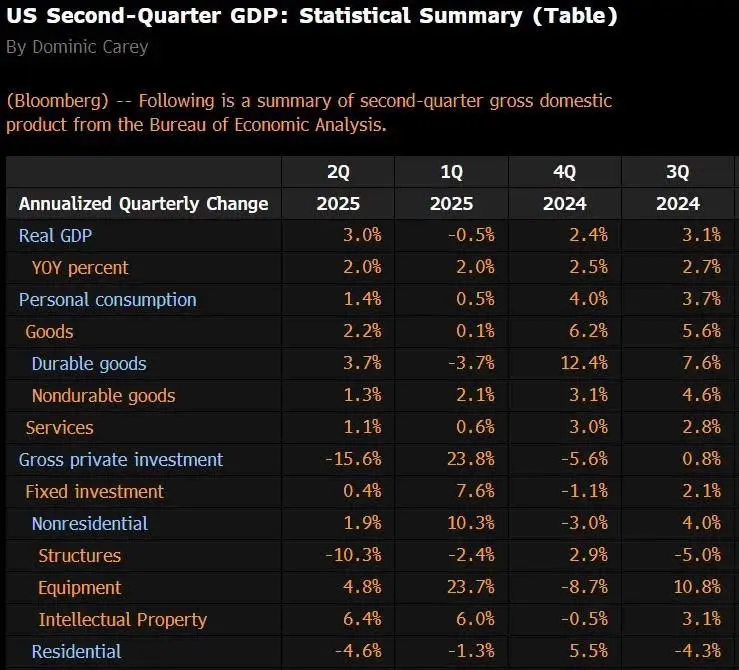

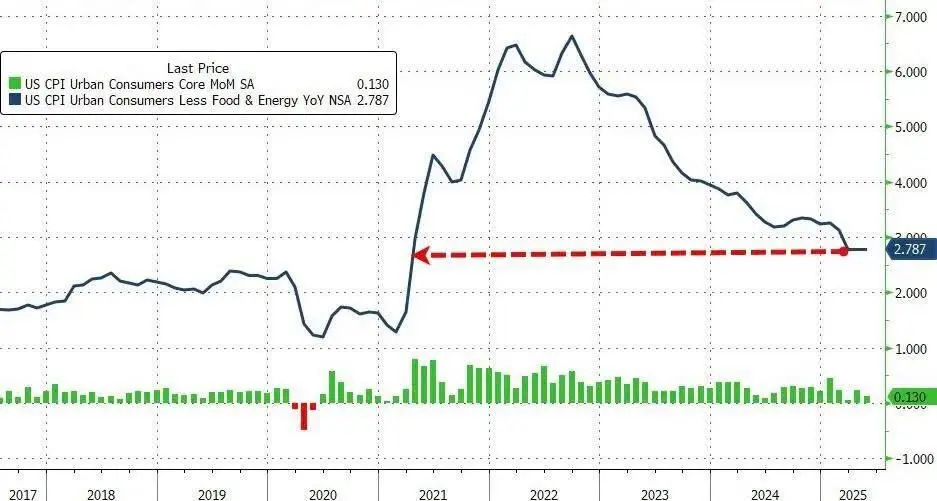

📍GDP America Q2/2025 rise to the sky +3.0%, trend reversal -0.5% of the previous quarter:

📌 GDP America Q2 bounced back to +3.0% Q/Q (annualized), far exceeding the forecast of 2.5% and completely reversing from the -0.5% decline of the previous quarter. The market reacted positively, but in essence, this is not a very good data.

high inflation has overshadowed the momentum of the economy.

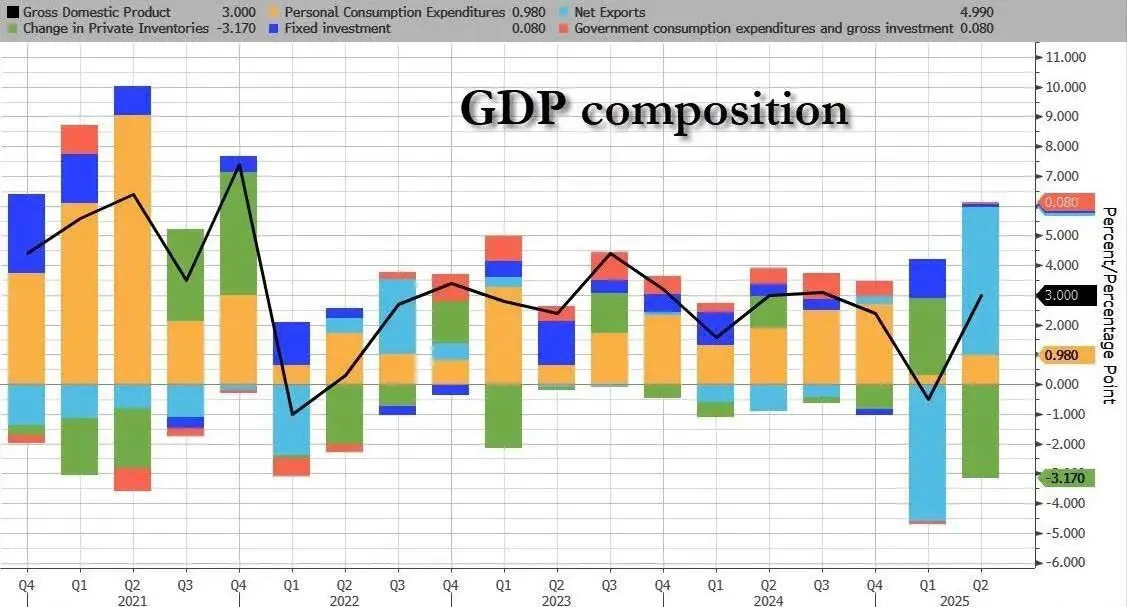

The real leverage has boosted GDP in Q2/2025:

- Exports contributed the most, up to +4.99% to growth (In Q1/2025, exports fell -4.66% which dragged GDP down ).

- Personal consumption improved slightly: +0

View Original📌 GDP America Q2 bounced back to +3.0% Q/Q (annualized), far exceeding the forecast of 2.5% and completely reversing from the -0.5% decline of the previous quarter. The market reacted positively, but in essence, this is not a very good data.

high inflation has overshadowed the momentum of the economy.

The real leverage has boosted GDP in Q2/2025:

- Exports contributed the most, up to +4.99% to growth (In Q1/2025, exports fell -4.66% which dragged GDP down ).

- Personal consumption improved slightly: +0

- Reward

- like

- Comment

- Share

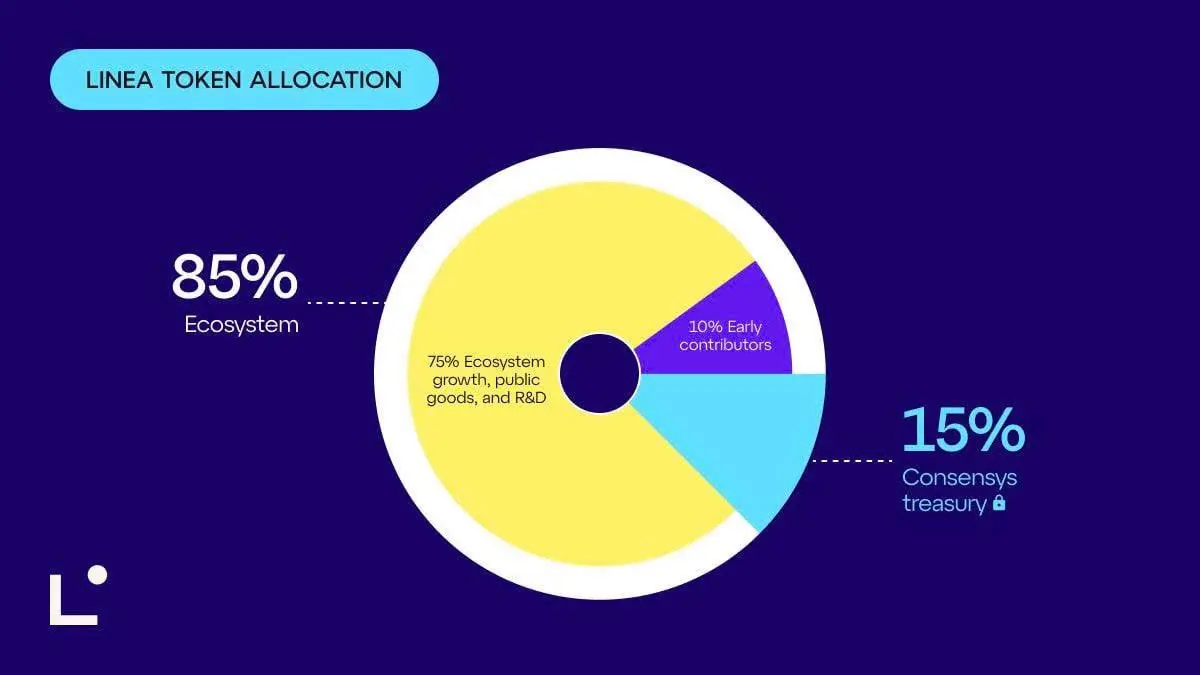

📍Linea announces tokenomics: 10% for airdrop, no tokens for the team and VC.

📌 The total supply of LINEA reaches 72 billion (, 1,000 times that of ETH):

- 10% for the community (, 9% for Voyage users, 1% for the ecosystem project ).

- 15% for Consensys treasury, locked for 5 years.

- 75% is the ecosystem fund managed by Linea Consortium for 10 years - no VC fund, not shared with the team.

📌 The gas fee is paid in ETH, but with a special mechanism: 80% of the ETH collected will be used to buy back and burn LINEA → dual deflation (ETH & LINEA). Users bridging ETH to Linea will also be automat

View Original📌 The total supply of LINEA reaches 72 billion (, 1,000 times that of ETH):

- 10% for the community (, 9% for Voyage users, 1% for the ecosystem project ).

- 15% for Consensys treasury, locked for 5 years.

- 75% is the ecosystem fund managed by Linea Consortium for 10 years - no VC fund, not shared with the team.

📌 The gas fee is paid in ETH, but with a special mechanism: 80% of the ETH collected will be used to buy back and burn LINEA → dual deflation (ETH & LINEA). Users bridging ETH to Linea will also be automat

- Reward

- like

- Comment

- Share

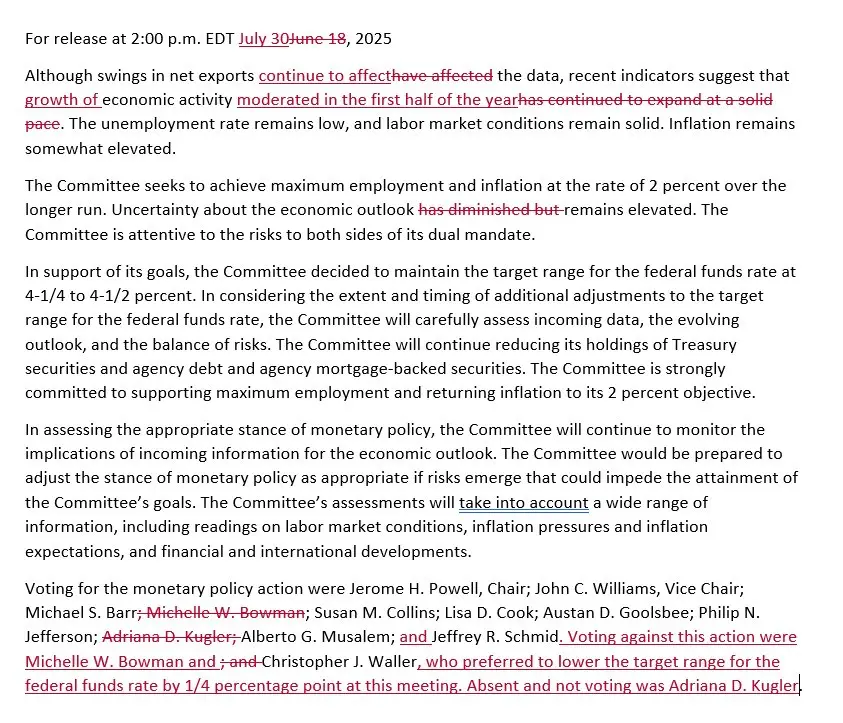

📍FOMC July - interest rates stay tuned, market expectations collapsed.

📌 The Fed stayed tuned with the interest rate at 4.25–4.5%, but this time there were 2 votes wanting to cut from Bowman and Waller ( for the first time since 1993 with two members of the Board of Governors openly opposing the hold on interest rates ).

Fed internal polarization.

📌 The dot plot hasn’t changed much, indicating expectations of 2 rate cuts in 2025, but Powell threw a cold water on the September expectations: "The next move is largely neutral" - meaning neither a cut nor an increase, and very likely doing not

View Original📌 The Fed stayed tuned with the interest rate at 4.25–4.5%, but this time there were 2 votes wanting to cut from Bowman and Waller ( for the first time since 1993 with two members of the Board of Governors openly opposing the hold on interest rates ).

Fed internal polarization.

📌 The dot plot hasn’t changed much, indicating expectations of 2 rate cuts in 2025, but Powell threw a cold water on the September expectations: "The next move is largely neutral" - meaning neither a cut nor an increase, and very likely doing not

- Reward

- like

- Comment

- Share

🚨Countdown to the FOMC: Just hours left.

No time for put 😎

No time for put 😎

- Reward

- like

- Comment

- Share

📍From a fanciful idea, Ethereum has gone far beyond the dreams of the most optimistic.

📌 Ten years ago, Ethereum was just an ambitious whitepaper by the 19-year-old Vitalik Buterin, who asked the question: "Why is blockchain only used for transferring money and not programmable?" That idea was once considered fanciful, too far removed from the reality of a financial world still tightly bound to intermediaries, banks, and legalities.

📌 On July 30, 2015, Ethereum officially went live. The concept of the blockchain trilemma was also born from this. No one could have imagined that this young pl

View Original📌 Ten years ago, Ethereum was just an ambitious whitepaper by the 19-year-old Vitalik Buterin, who asked the question: "Why is blockchain only used for transferring money and not programmable?" That idea was once considered fanciful, too far removed from the reality of a financial world still tightly bound to intermediaries, banks, and legalities.

📌 On July 30, 2015, Ethereum officially went live. The concept of the blockchain trilemma was also born from this. No one could have imagined that this young pl

- Reward

- like

- Comment

- Share

📍 SEC greenlights crypto: BTC and ETH ETFs to be settled In-kind

- The SEC has officially allowed the in-kind creation/redemption mechanism for all Bitcoin and Ethereum spot ETFs, instead of cash as before.

- The new approach helps organizations trade more effectively, at lower costs, avoiding market fluctuations.

- This is the first crypto-friendly policy under the new leadership of Chairman Paul S. Atkins.

- The SEC is also expanding options contracts, increasing positions up to 250,000 contracts and licensing mixed ETFs #BTC + #ETH.

View Original- The SEC has officially allowed the in-kind creation/redemption mechanism for all Bitcoin and Ethereum spot ETFs, instead of cash as before.

- The new approach helps organizations trade more effectively, at lower costs, avoiding market fluctuations.

- This is the first crypto-friendly policy under the new leadership of Chairman Paul S. Atkins.

- The SEC is also expanding options contracts, increasing positions up to 250,000 contracts and licensing mixed ETFs #BTC + #ETH.

- Reward

- like

- Comment

- Share

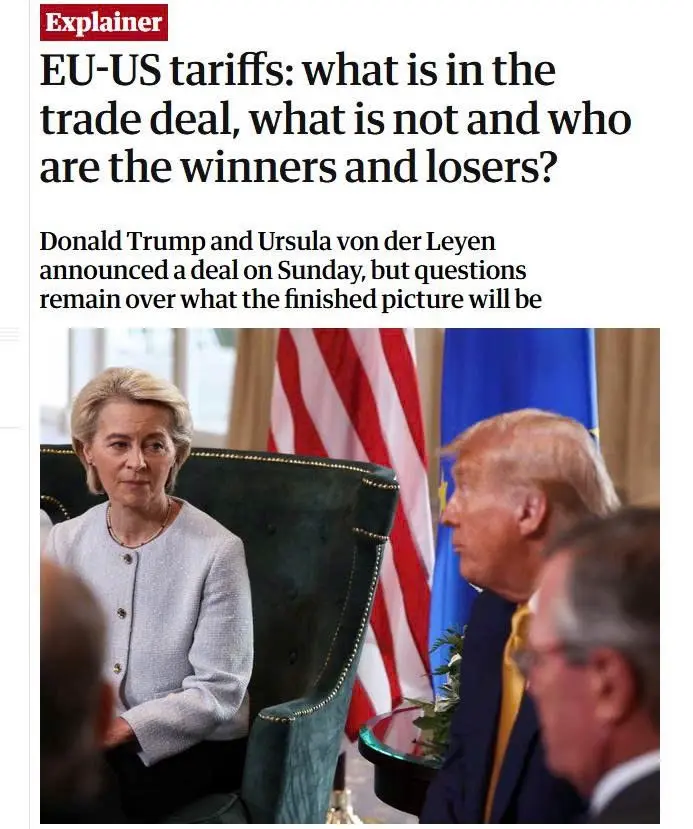

📍Europe surrenders to Trump: The new trade agreement is entirely imposed by America.

A unilateral concession from the EU.

📌 The EU commits to investing $600B in America and purchasing $750B in American energy by 2028, but later admits it cannot guarantee implementation, as it relies on the private sector rather than a common policy. America maintains a 50% tariff on steel and aluminum from the EU, and the quota has not yet been agreed upon.

reinforcing the MAGA image: Trump protects American businesses at all costs.

💭 A forced and asymmetrical agreement. European press criticized the EU a

View OriginalA unilateral concession from the EU.

📌 The EU commits to investing $600B in America and purchasing $750B in American energy by 2028, but later admits it cannot guarantee implementation, as it relies on the private sector rather than a common policy. America maintains a 50% tariff on steel and aluminum from the EU, and the quota has not yet been agreed upon.

reinforcing the MAGA image: Trump protects American businesses at all costs.

💭 A forced and asymmetrical agreement. European press criticized the EU a

- Reward

- like

- Comment

- Share

🚨DXY is rising. Risk assets are under pressure ahead of the July FOMC meeting.

View Original

- Reward

- like

- Comment

- Share

📍People in America still "doubt" cryptocurrency: Clearly a good signal?

📌 Surveys show that only 14% of American adults own crypto, and the majority of the population is still on the sidelines. While institutional investment funds are increasing their presence, 64% of individual investors view crypto as "very risky," a rate that has not decreased compared to previous years.

📌 60% of Americans do not intend to buy crypto, and only 4% plan to buy. In fact, only 4% of Americans view crypto as the best long-term investment, lower than gold or stocks.

The expectation of widespread adoption is s

View Original📌 Surveys show that only 14% of American adults own crypto, and the majority of the population is still on the sidelines. While institutional investment funds are increasing their presence, 64% of individual investors view crypto as "very risky," a rate that has not decreased compared to previous years.

📌 60% of Americans do not intend to buy crypto, and only 4% plan to buy. In fact, only 4% of Americans view crypto as the best long-term investment, lower than gold or stocks.

The expectation of widespread adoption is s

- Reward

- like

- Comment

- Share

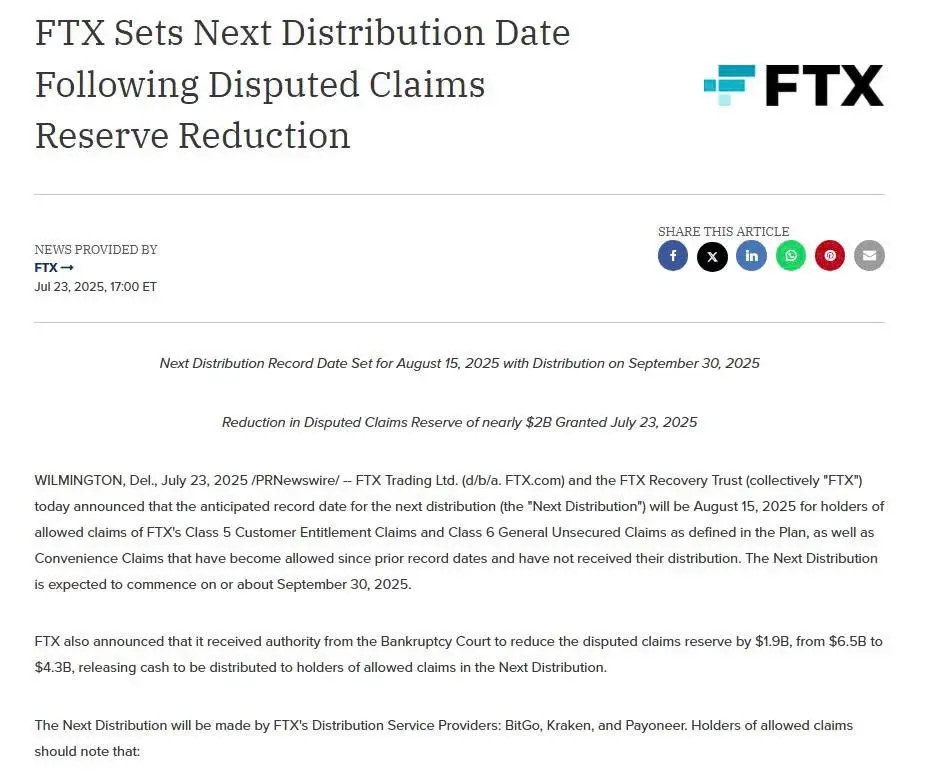

🚨 FTX confirms the third refund, will $1.9 be reinvested into the market or cashed out?

📌 FTX has been approved by the Delaware court to disburse an additional $1.9B to creditors across 3 groups:

- Class 5: depositors on the exchange

- Class 6: unsecured creditors

- Convenience Class: requires under $50K

📌 After FTX has repaid $1.2B ( tranche 1) and $5B ( tranche 2), the third tranche is expected to begin refunds on 30/09. Right after the Fed lowers interest rates.

📌 The likelihood of this cash flow reversing back into the market is quite high as the market is extremely active.

📌 FTX has been approved by the Delaware court to disburse an additional $1.9B to creditors across 3 groups:

- Class 5: depositors on the exchange

- Class 6: unsecured creditors

- Convenience Class: requires under $50K

📌 After FTX has repaid $1.2B ( tranche 1) and $5B ( tranche 2), the third tranche is expected to begin refunds on 30/09. Right after the Fed lowers interest rates.

📌 The likelihood of this cash flow reversing back into the market is quite high as the market is extremely active.

CHO-1.31%

- Reward

- like

- Comment

- Share

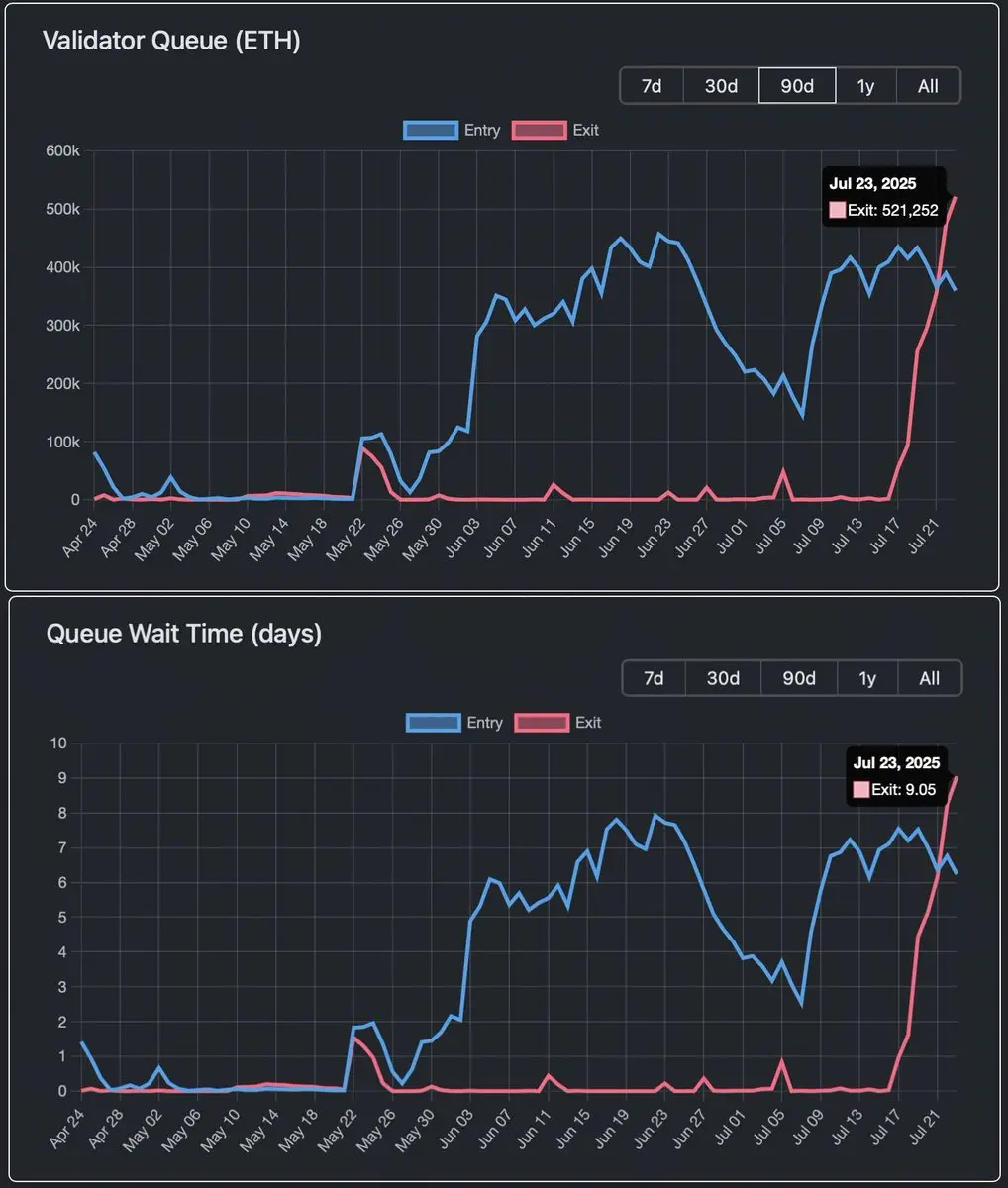

📉 ETH is unstaked with the highest volume 2: Is there reason to worry?

Ethereum has just recorded its largest unstake event since the beginning of 2024, with over 644,000 ETH (~$2.3B) waiting to be unlocked. The withdrawal queue has reached 11 days - the highest in the past 18 months. Most of it comes from validators.

ETH has increased by more than +160% since April, so it's not surprising to unstake to realize profits, especially since Ethereum's unstaking mechanism has a waiting period - so unstaking in parts is a natural thing.

The second reason is the unwinding of looping strategies (borr

View OriginalEthereum has just recorded its largest unstake event since the beginning of 2024, with over 644,000 ETH (~$2.3B) waiting to be unlocked. The withdrawal queue has reached 11 days - the highest in the past 18 months. Most of it comes from validators.

ETH has increased by more than +160% since April, so it's not surprising to unstake to realize profits, especially since Ethereum's unstaking mechanism has a waiting period - so unstaking in parts is a natural thing.

The second reason is the unwinding of looping strategies (borr

- Reward

- 1

- Comment

- Share

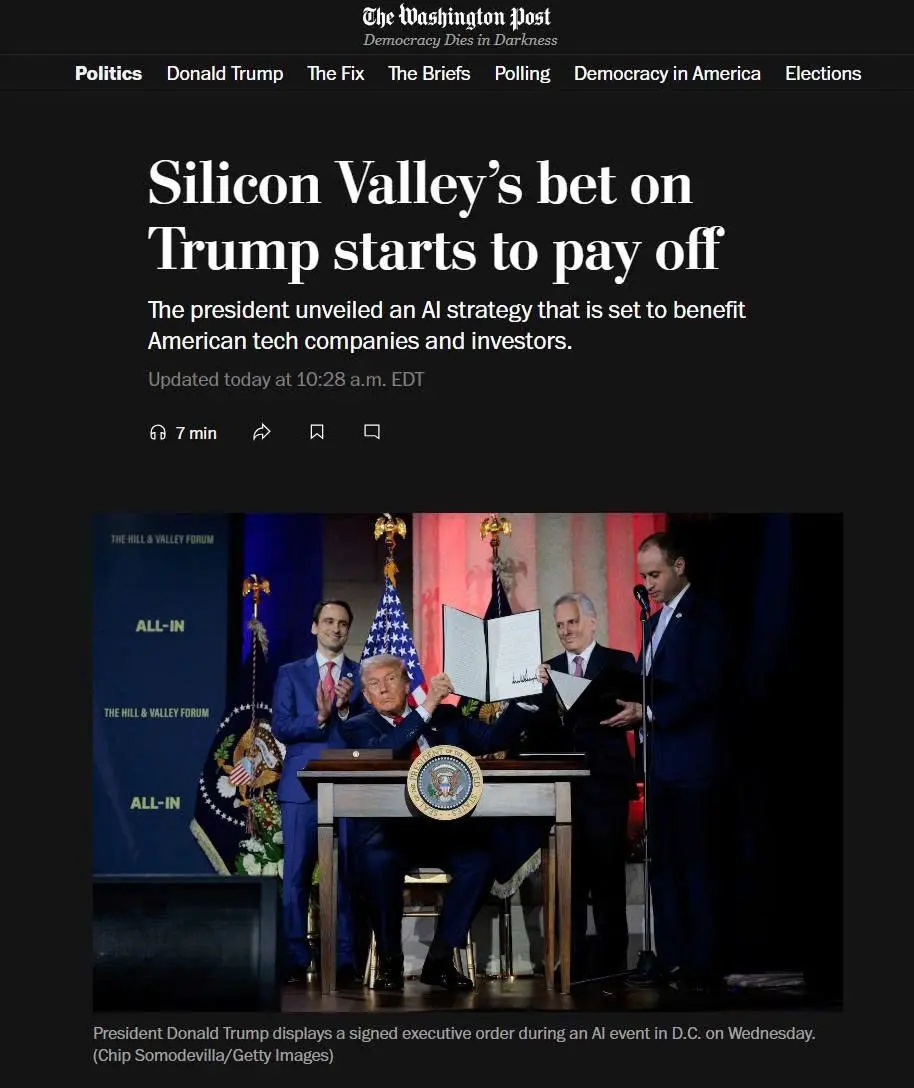

📍America announces "America's Plan to Win the AI Race"

📌 This plan focuses on three pillars:

- Accelerate innovation

- Build large-scale AI infrastructure

- Leading the technology diplomacy game (export AI)

While the rest of the world is still debating the limitations and ethics of AI, the White House has jumped ahead into the game, AI has become a resource of the future and America wants to turn AI into a "new power".

📌 America will "remove federal regulations that hinder the development and deployment of AI", withdraw federal funding from states that "hinder AI".

Remove all legal barrie

View Original📌 This plan focuses on three pillars:

- Accelerate innovation

- Build large-scale AI infrastructure

- Leading the technology diplomacy game (export AI)

While the rest of the world is still debating the limitations and ethics of AI, the White House has jumped ahead into the game, AI has become a resource of the future and America wants to turn AI into a "new power".

📌 America will "remove federal regulations that hinder the development and deployment of AI", withdraw federal funding from states that "hinder AI".

Remove all legal barrie

- Reward

- like

- Comment

- Share

🚨 Tether confirms plans to return to the America market

🇺🇸CEO Paolo Ardoino stated that Tether is preparing to release a USDT version specifically for the American market, after the GENIUS Act is officially signed into law.

📌 The new stablecoin will strictly comply with requirements:

- 100% backed by USD or liquid assets

- Regular audit

- Comply with AML

👉 This is the first time Tether has publicly confirmed its intention to return to America under a new legal framework, paving the way for #USDT to operate officially in the largest market in the world.

View Original🇺🇸CEO Paolo Ardoino stated that Tether is preparing to release a USDT version specifically for the American market, after the GENIUS Act is officially signed into law.

📌 The new stablecoin will strictly comply with requirements:

- 100% backed by USD or liquid assets

- Regular audit

- Comply with AML

👉 This is the first time Tether has publicly confirmed its intention to return to America under a new legal framework, paving the way for #USDT to operate officially in the largest market in the world.

- Reward

- like

- Comment

- Share

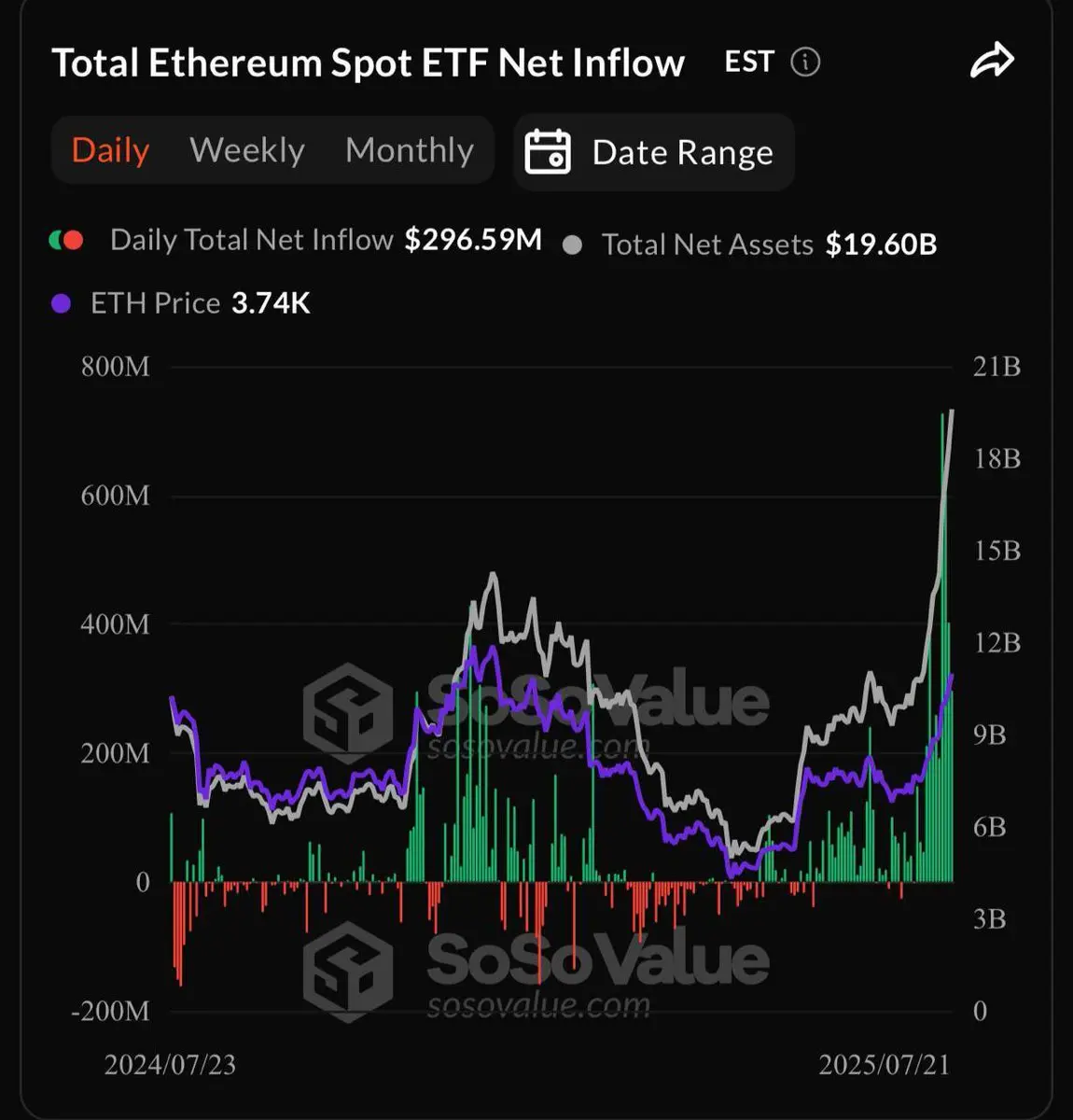

🚨 The "Ethereum flippening ETF narrative" is happening, showing no signs of fall.

📌 While Bitcoin Spot ETFs experienced an outflow of $131.4M yesterday, Ethereum Spot ETFs recorded an inflow of $296.6M, marking the 12th consecutive day of positive inflow.

📌 The AUM of ETH ETFs has now reached $19.6B, a strong increase from the $6B range in just one month.

💭 ETH is entering a strong revaluation phase as fund companies buy in large and continuous scale.

View Original📌 While Bitcoin Spot ETFs experienced an outflow of $131.4M yesterday, Ethereum Spot ETFs recorded an inflow of $296.6M, marking the 12th consecutive day of positive inflow.

📌 The AUM of ETH ETFs has now reached $19.6B, a strong increase from the $6B range in just one month.

💭 ETH is entering a strong revaluation phase as fund companies buy in large and continuous scale.

- Reward

- like

- Comment

- Share

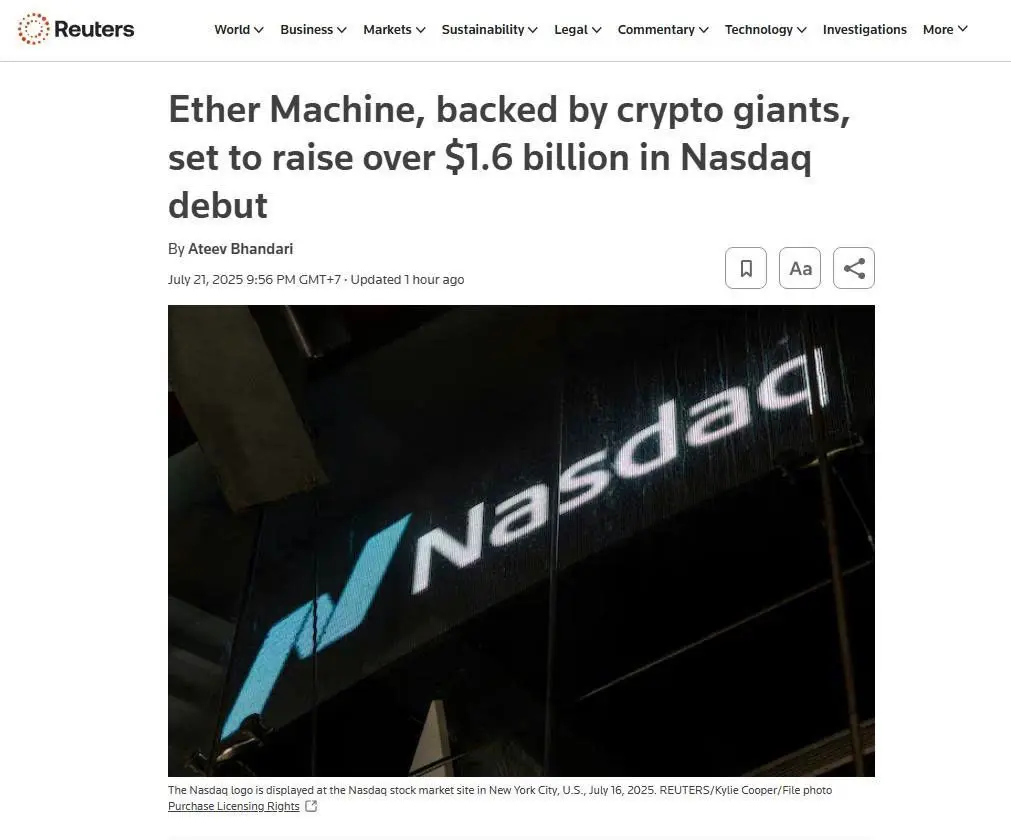

📍An American company wants to buy $1.6B worth of ETH and go public on Nasdaq.

📌 A company listed in America is about to merge with an Ethereum startup and list on Nasdaq under the ticker ETHM, aiming to raise 400,000 ETH (~$1.5B) to become the largest ETH holder in the world.

📌 Specifically, Dynamix merged with The Ether Reserve and rebranded as The Ether Machine, planning to list on Nasdaq under the ticker ETHM by the end of Q4/2025 ( through SPAC). The funding will come from:

- 400,000 $ETH (~$1.6B from the company's fund.

– 170,000 $ETH from Andrew Keys (ex-ConsenSys).

– $800M from major

View Original📌 A company listed in America is about to merge with an Ethereum startup and list on Nasdaq under the ticker ETHM, aiming to raise 400,000 ETH (~$1.5B) to become the largest ETH holder in the world.

📌 Specifically, Dynamix merged with The Ether Reserve and rebranded as The Ether Machine, planning to list on Nasdaq under the ticker ETHM by the end of Q4/2025 ( through SPAC). The funding will come from:

- 400,000 $ETH (~$1.6B from the company's fund.

– 170,000 $ETH from Andrew Keys (ex-ConsenSys).

– $800M from major

- Reward

- like

- Comment

- Share

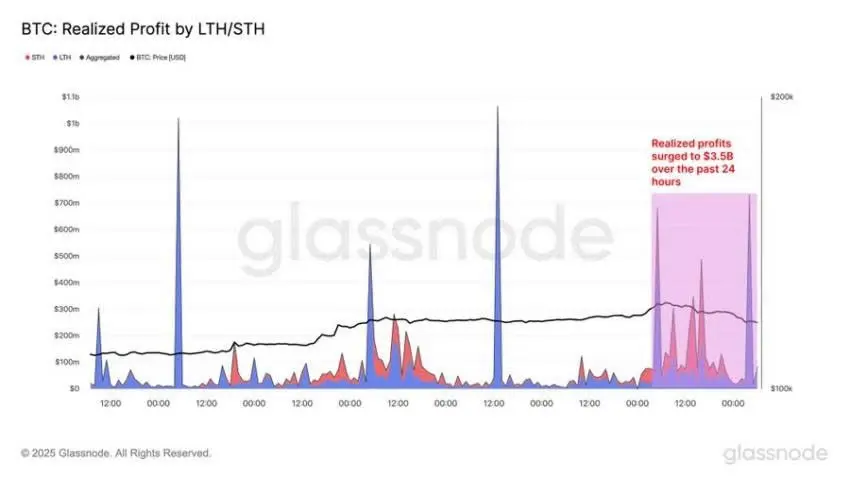

👉🏻👉🏻👉🏻Dapp:

💥You only need to log in once to trade meme coins on Ethereum, BNB, Solana… without the need for cross-chain or manual bridging. Chain abstraction has removed all the technical hassles, you just need to select the correct contract.

✨This is quite convenient for beginners in trading dex:

- No setup required: No need to learn how to create a sub-wallet, no need to configure the bot wallet, slippage, block speed... You just need a Web3 wallet to use it.

- No chain limitations: Most bots are restricted to their own hst (, for example, Maestro primarily on ETH). Universal X is m

View Original💥You only need to log in once to trade meme coins on Ethereum, BNB, Solana… without the need for cross-chain or manual bridging. Chain abstraction has removed all the technical hassles, you just need to select the correct contract.

✨This is quite convenient for beginners in trading dex:

- No setup required: No need to learn how to create a sub-wallet, no need to configure the bot wallet, slippage, block speed... You just need a Web3 wallet to use it.

- No chain limitations: Most bots are restricted to their own hst (, for example, Maestro primarily on ETH). Universal X is m

- Reward

- like

- Comment

- Share

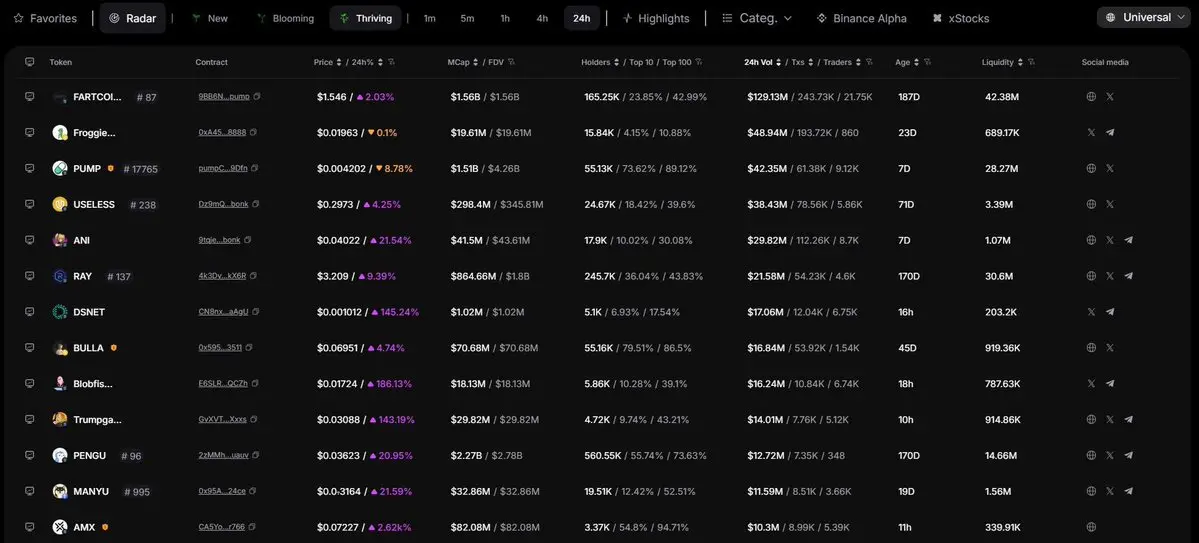

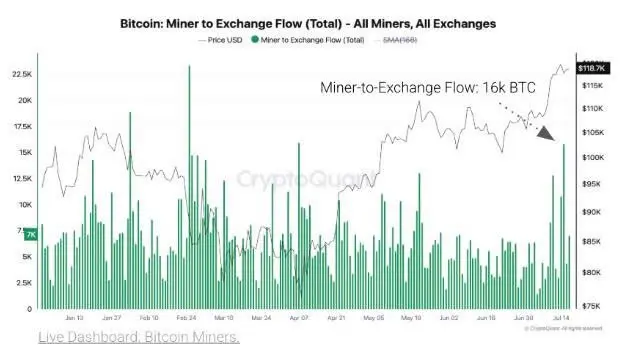

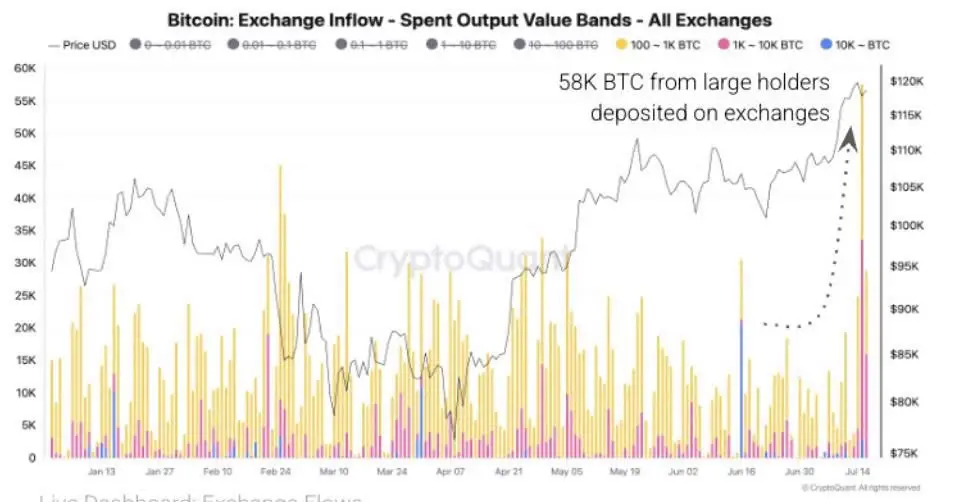

📍Miners sold the most since April: 16,000 BTC from miners were dumped in one day.

📌 As soon as BTC surpassed $123K, selling pressure began to increase from miners: Over 16,000 BTC were pushed to the exchange in a day - marking the largest sell-off since April 7. The BTC reserves of miners dropped to 65,000 BTC, the lowest level in a month, indicating that they timed this moment.

📌Whales are also taking the opportunity to sell: The amount of BTC transferred to exchanges in a single day reached 81,000 $BTC, with large addresses accounting for 58,000 BTC. The estimated total realized profit fo

View Original📌 As soon as BTC surpassed $123K, selling pressure began to increase from miners: Over 16,000 BTC were pushed to the exchange in a day - marking the largest sell-off since April 7. The BTC reserves of miners dropped to 65,000 BTC, the lowest level in a month, indicating that they timed this moment.

📌Whales are also taking the opportunity to sell: The amount of BTC transferred to exchanges in a single day reached 81,000 $BTC, with large addresses accounting for 58,000 BTC. The estimated total realized profit fo

- Reward

- like

- Comment

- Share

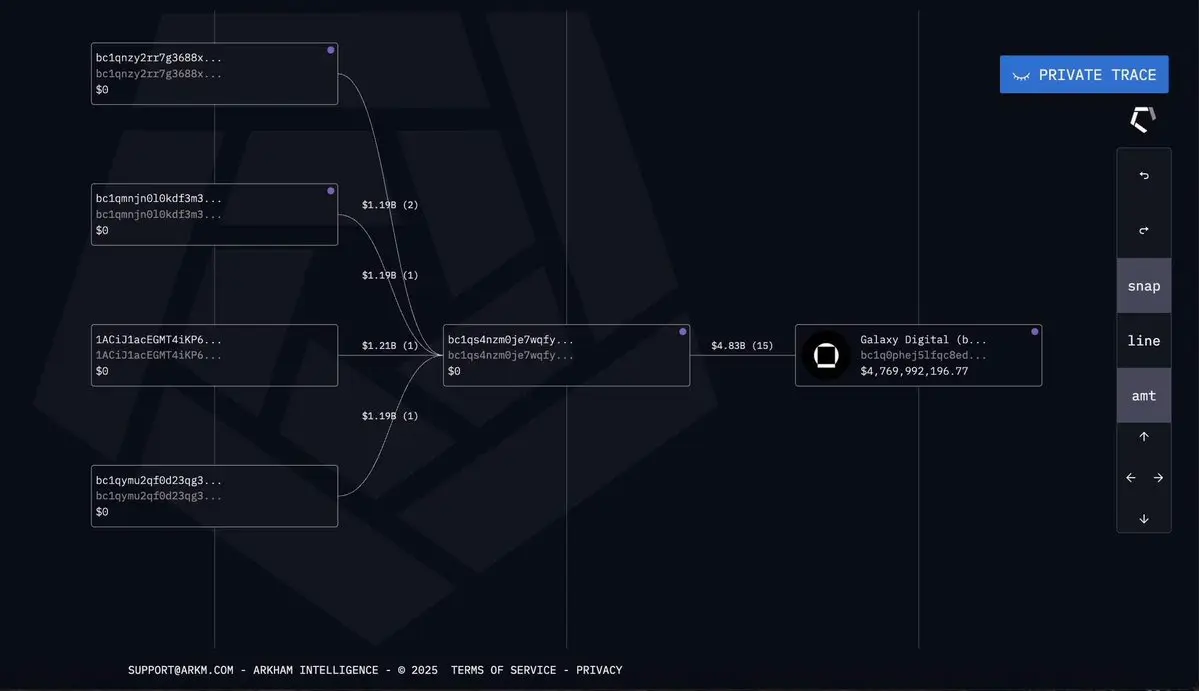

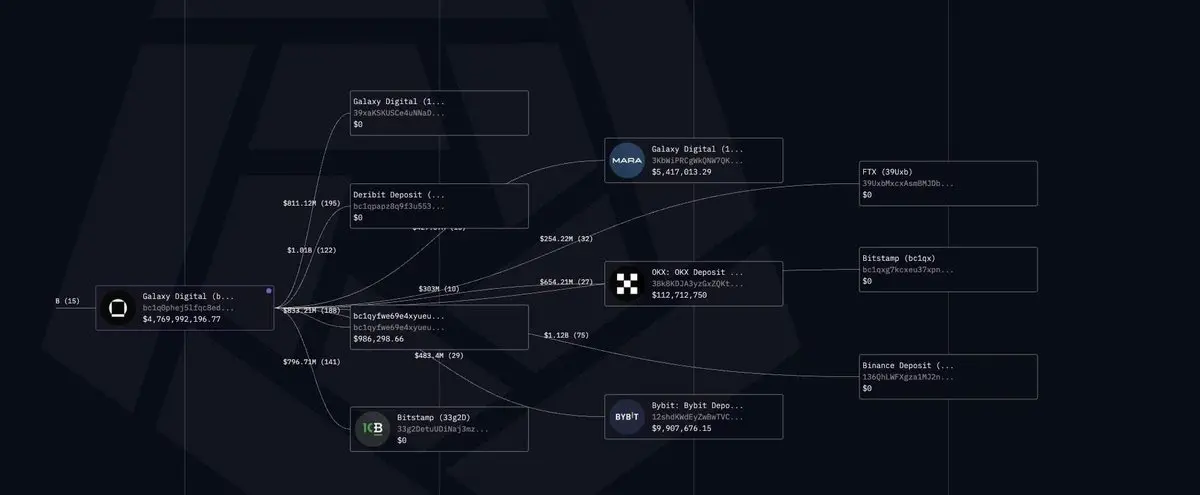

📌A total of 80,000 BTC has left the original wallet, with the distribution finalized through the OTC channel. This whale has asked MM to handle the distribution of the enormous amount instead of dumping it themselves, which could have a significant impact on the price.

View Original

- Reward

- like

- Comment

- Share

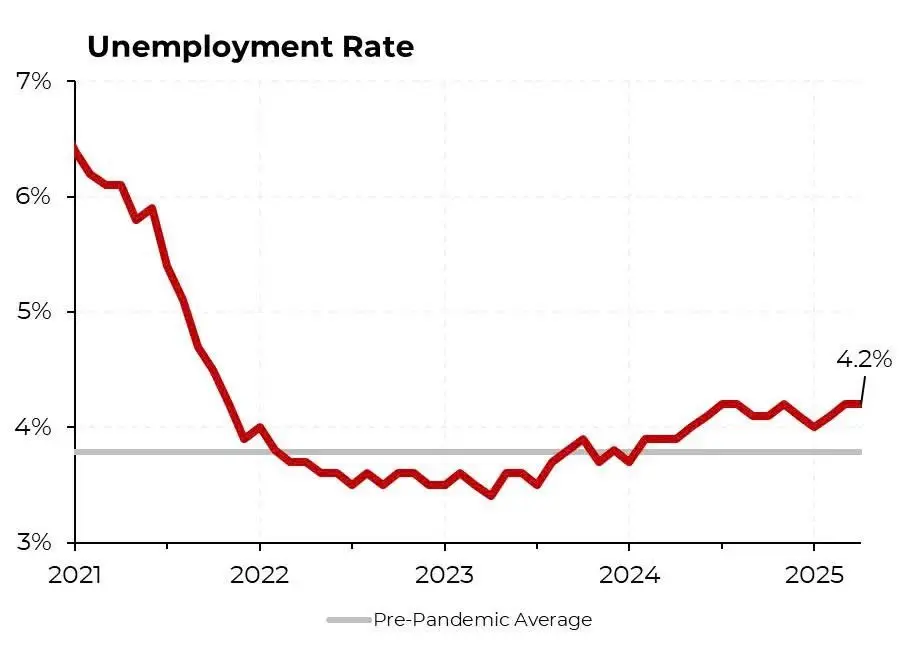

🚨 The Fed is struggling to escape the pressure of holding interest rates high for too long.

✨After three rate cuts in 2024, the Fed has held the interest rate at 4.25–4.50% since December due to concerns about inflation and risks from Trump's tariffs. The market no longer expects the Fed to cut rates significantly this summer. There is over a 90% chance that the Fed will keep the interest rate unchanged at the July meeting.

Surveys from Reuters, WSJ, and Bloomberg all indicate that September will be a turning point:

- Up to 55% of experts forecast a rate cut in Q3 ( around month 9), while the

View Original✨After three rate cuts in 2024, the Fed has held the interest rate at 4.25–4.50% since December due to concerns about inflation and risks from Trump's tariffs. The market no longer expects the Fed to cut rates significantly this summer. There is over a 90% chance that the Fed will keep the interest rate unchanged at the July meeting.

Surveys from Reuters, WSJ, and Bloomberg all indicate that September will be a turning point:

- Up to 55% of experts forecast a rate cut in Q3 ( around month 9), while the

- Reward

- like

- Comment

- Share