Syed92110

No content yet

Syed92110

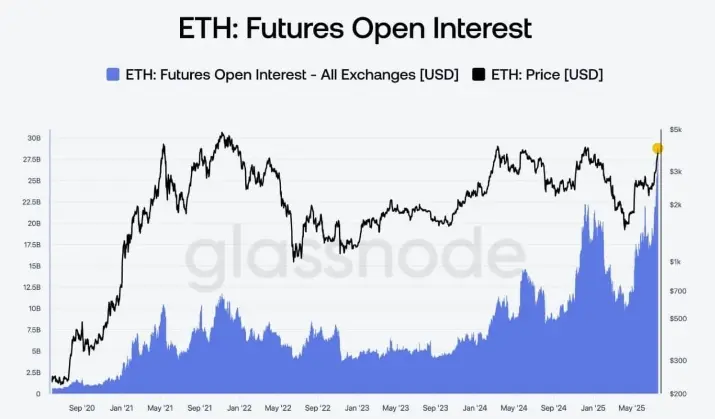

#ETH Trading Volume Surges#

$BTC $ETH Soon in Coming Days I will share Accurate Time of Big Big Big Move like I have shared so many time in the past.

Move will be UP or Down that would be Surprise 😉

IF you are Day trader, Future, Spot or swing trader, I provide accurate Signals/Zones of BTC ETH & other ALTS on a daily, weekly or monthly basis to my Members. (Sometimes after Every 12 Hours)

Huge Moves are to be expected what would be the day and what it would be extreme bearish or Bullish.

Be a one To get the benefits, Community is everything.

As always Trade Safe.

Your Friend: ShowdownPRO

$BTC $ETH Soon in Coming Days I will share Accurate Time of Big Big Big Move like I have shared so many time in the past.

Move will be UP or Down that would be Surprise 😉

IF you are Day trader, Future, Spot or swing trader, I provide accurate Signals/Zones of BTC ETH & other ALTS on a daily, weekly or monthly basis to my Members. (Sometimes after Every 12 Hours)

Huge Moves are to be expected what would be the day and what it would be extreme bearish or Bullish.

Be a one To get the benefits, Community is everything.

As always Trade Safe.

Your Friend: ShowdownPRO

- Reward

- like

- Comment

- Share

#BTC Market Analysis#

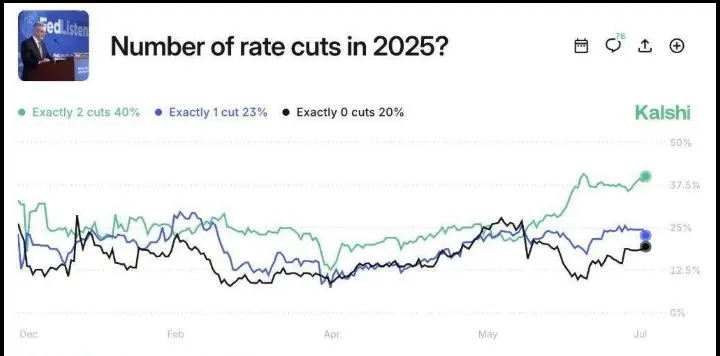

🚨🚨 Wall Street is Warming Up to Rate Cuts—Will Crypto Be the Biggest Winner⁉️😱

Wall Street’s warming up to rate cuts. With inflation falling and Trump calling for a 300bps cut (claiming it would save the US economy $1 trillion annually and that Federal Reserve Chair James Powell is keeping rates high for “political reasons”), markets are eyeing a potential Fed pivot as soon as September. Goldman expects the first cut in Q3, while Kalshi gives a 40% chance of two cuts by year-end.

That’s seriously bullish for crypto. Rate cuts typically boost risk assets; BTC jumped fro

🚨🚨 Wall Street is Warming Up to Rate Cuts—Will Crypto Be the Biggest Winner⁉️😱

Wall Street’s warming up to rate cuts. With inflation falling and Trump calling for a 300bps cut (claiming it would save the US economy $1 trillion annually and that Federal Reserve Chair James Powell is keeping rates high for “political reasons”), markets are eyeing a potential Fed pivot as soon as September. Goldman expects the first cut in Q3, while Kalshi gives a 40% chance of two cuts by year-end.

That’s seriously bullish for crypto. Rate cuts typically boost risk assets; BTC jumped fro

- Reward

- like

- Comment

- Share

SUI analysis:

Price has broken through the resistance area and retested it. You can open a long position at the support area. We may see a move toward the resistance area, and if it breaks, then a move toward the all-time high price.

Support Area: $3.54-$3.66

Resistance Area: $4.25-$4.35

Price has broken through the resistance area and retested it. You can open a long position at the support area. We may see a move toward the resistance area, and if it breaks, then a move toward the all-time high price.

Support Area: $3.54-$3.66

Resistance Area: $4.25-$4.35

SUI8.18%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

#Trump’s AI Strategy#

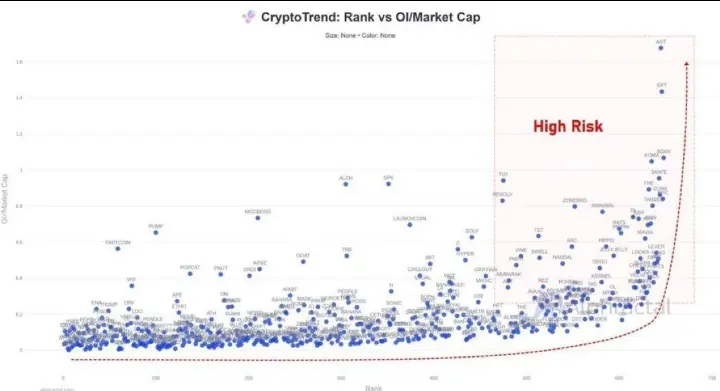

The Market Is Leveraging Up on Small-Cap Coins: Altseason or a Bull Trap?

The chart below shows the relationship between market cap rank and the OI/Market Cap ratio (open interest relative to spot cap).

A high ratio means derivatives are driving price action — which increases the risk of a liquidation squeeze.

Now focus on the bottom-right section (Rank 500+ tokens) like AGT, EPT, BDXN, KOM, FHE, GRCK. Their OI/Market Cap ratios are nearing or exceeding 1.0.

→ This means the size of open leveraged positions is equal to or greater than their total spot market cap.

Current-

The Market Is Leveraging Up on Small-Cap Coins: Altseason or a Bull Trap?

The chart below shows the relationship between market cap rank and the OI/Market Cap ratio (open interest relative to spot cap).

A high ratio means derivatives are driving price action — which increases the risk of a liquidation squeeze.

Now focus on the bottom-right section (Rank 500+ tokens) like AGT, EPT, BDXN, KOM, FHE, GRCK. Their OI/Market Cap ratios are nearing or exceeding 1.0.

→ This means the size of open leveraged positions is equal to or greater than their total spot market cap.

Current-

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

#Gate ETH 10th Anniversary Celebration#

Bitcoin Dominance reached a support area and then bounced back from it. This is a straightforward observation of price action, as the price recovered after hitting the support zone. Currently, all altcoins are experiencing a correction due to the rise in Bitcoin dominance. The resistance level is around 63%, and we might see a reversal from that point.

Bitcoin Dominance reached a support area and then bounced back from it. This is a straightforward observation of price action, as the price recovered after hitting the support zone. Currently, all altcoins are experiencing a correction due to the rise in Bitcoin dominance. The resistance level is around 63%, and we might see a reversal from that point.

- Reward

- like

- Comment

- Share

$OP Weekly Chart Analysis

Optimism ($OP) has successfully retested the major weekly support zone (around $0.60–$0.44) and is now showing signs of a potential bullish reversal. Price has broken above the descending trendline, signaling a shift in momentum. If this breakout holds, the next key target lies at TP1 – $2.581, with further upside potential toward the $4.72 zone. Holding above the current structure supports a bullish continuation.

#OP # CryptoAnalysis #AltcoinSeason

Optimism ($OP) has successfully retested the major weekly support zone (around $0.60–$0.44) and is now showing signs of a potential bullish reversal. Price has broken above the descending trendline, signaling a shift in momentum. If this breakout holds, the next key target lies at TP1 – $2.581, with further upside potential toward the $4.72 zone. Holding above the current structure supports a bullish continuation.

#OP # CryptoAnalysis #AltcoinSeason

OP1.75%

- Reward

- like

- Comment

- Share

Lost around $700 this week after taking a friend’s advice to buy Solana. The lesson I’ve learned is to follow your own instincts, be patient and trust the process.

- Reward

- like

- Comment

- Share

#Stablecoin Regulation Crackdown#

$BTC /USDT ANALYSIS

Bitcoin is consolidating within a descending triangle pattern and is currently trading above the horizontal demand zone.

The price is also moving inside the Ichimoku Cloud, indicating indecision in the market. A breakout or breakdown from the pattern will confirm the next directional move.

$BTC /USDT ANALYSIS

Bitcoin is consolidating within a descending triangle pattern and is currently trading above the horizontal demand zone.

The price is also moving inside the Ichimoku Cloud, indicating indecision in the market. A breakout or breakdown from the pattern will confirm the next directional move.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

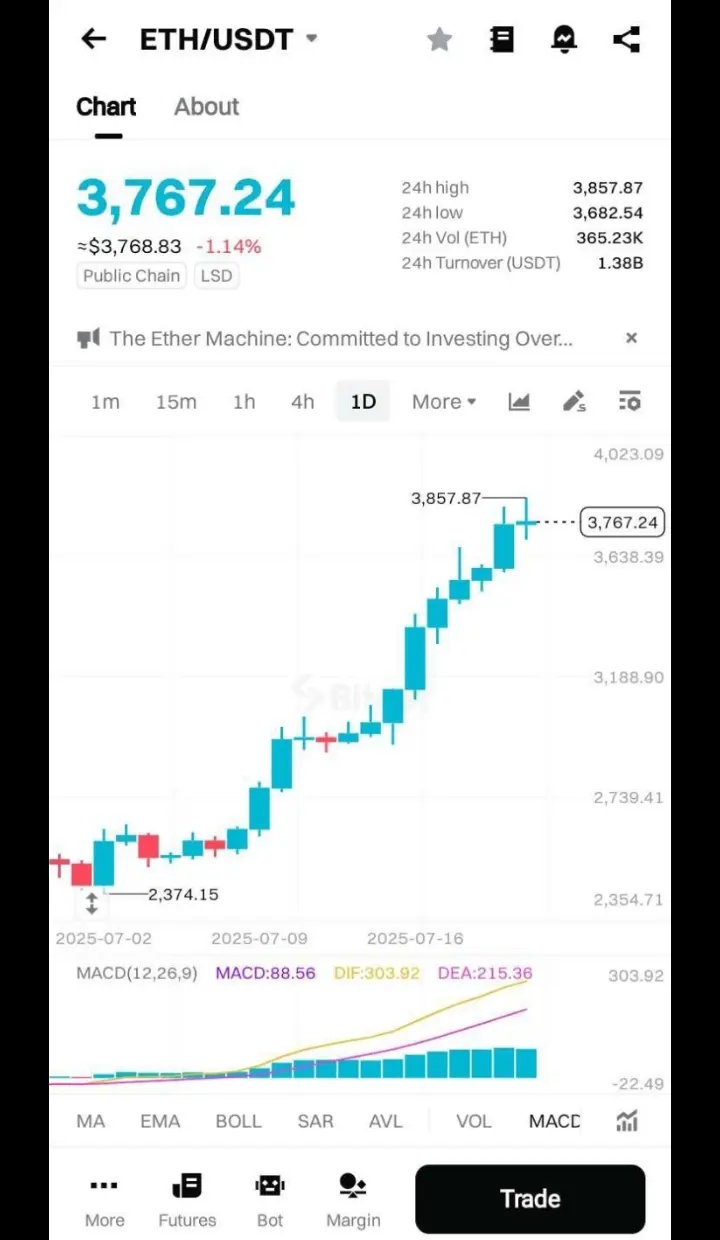

#ETH Breaks Through $3,800#

Ethereum (ETH) is continuing its upward movement and has gained over 33% in profit. The price is now approaching a key resistance area, and we will see if it can break above it. A break and close above $4,100 will drive the price towards the all-time high resistance level. Conversely, a rejection from this resistance area could lead the price back down to the $3,500 level.

Resistance Area: $3970-$4100

Ethereum (ETH) is continuing its upward movement and has gained over 33% in profit. The price is now approaching a key resistance area, and we will see if it can break above it. A break and close above $4,100 will drive the price towards the all-time high resistance level. Conversely, a rejection from this resistance area could lead the price back down to the $3,500 level.

Resistance Area: $3970-$4100

- Reward

- like

- Comment

- Share

XRP price sets eyes on new record highs amid steady digital asset fund inflows :

XRP sits on a 25% weekly gain, underpinned by steady institutional and retail demand.

XRP investment products saw a surge in capital inflow to $36 million last week as total net crypto fund inflows reached a record $4.4 billion.

A spike in whale-to-exchange transactions risks XRP's uptrend if investors reduce exposure for profit.

Ripple (XRP) is gaining momentum and closing in on its all-time high of $3.66 on Monday. The bullish outlook is supported by institutional demand, which continues to drive the expansion o

XRP sits on a 25% weekly gain, underpinned by steady institutional and retail demand.

XRP investment products saw a surge in capital inflow to $36 million last week as total net crypto fund inflows reached a record $4.4 billion.

A spike in whale-to-exchange transactions risks XRP's uptrend if investors reduce exposure for profit.

Ripple (XRP) is gaining momentum and closing in on its all-time high of $3.66 on Monday. The bullish outlook is supported by institutional demand, which continues to drive the expansion o

XRP2.65%

- Reward

- like

- Comment

- Share

#ETH Breaks Through $3,800#

Candlestick chart of the ETH/USDT trading pair.

highlighting Ethereum’s recent price performance on a cryptocurrency trading platform. At the time of capture, Ethereum (ETH) is priced at $3,767.24, reflecting a 1.14% intraday decline. Despite this minor pullback, the chart illustrates a strong bullish momentum over the past few weeks, with ETH surging from a recent low of $2,374.15 to a 24-hour high of $3,857.87.

The MACD indicator at the bottom further reinforces this upward trend, showing widening divergence between the MACD line (88.56) and the signal line (DEA

Candlestick chart of the ETH/USDT trading pair.

highlighting Ethereum’s recent price performance on a cryptocurrency trading platform. At the time of capture, Ethereum (ETH) is priced at $3,767.24, reflecting a 1.14% intraday decline. Despite this minor pullback, the chart illustrates a strong bullish momentum over the past few weeks, with ETH surging from a recent low of $2,374.15 to a 24-hour high of $3,857.87.

The MACD indicator at the bottom further reinforces this upward trend, showing widening divergence between the MACD line (88.56) and the signal line (DEA

- Reward

- like

- Comment

- Share

⚠️ “𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗪𝗶𝗹𝗹 𝗕𝘂𝘀𝘁 𝗧𝗼𝗼”- 𝗥𝗼𝗯𝗲𝗿𝘁 𝗞𝗶𝘆𝗼𝘀𝗮𝗸𝗶 𝗪𝗮𝗿𝗻𝘀 𝗼𝗳 𝗜𝗻𝗰𝗼𝗺𝗶𝗻𝗴 𝗖𝗿𝗮𝘀𝗵 𝗔𝗰𝗿𝗼𝘀𝘀 𝗔𝗹𝗹 𝗔𝘀𝘀𝗲𝘁𝘀

Robert Kiyosaki predicts that major economic bubbles in the U.S. will burst, triggering sharp corrections in gold, silver, and Bitcoin

I kinda Disagree though. There would only be minor corrections on $BTC not a crash .

Well, just my own opinion .

Drop your own in the comments...

Robert Kiyosaki predicts that major economic bubbles in the U.S. will burst, triggering sharp corrections in gold, silver, and Bitcoin

I kinda Disagree though. There would only be minor corrections on $BTC not a crash .

Well, just my own opinion .

Drop your own in the comments...

- Reward

- like

- Comment

- Share

#Altcoins on the Rise#

🚨 PENGU Eyes Potential Breakout as NFT Volume Surges

A bull flag pattern on $PENGU suggests a potential 142% upside move toward $0.081.

At the same time, Pudgy Penguins NFT trading volume has jumped 273%, fueling market speculation around the ecosystem.

Could momentum in NFTs drive the next rally for

🚨 PENGU Eyes Potential Breakout as NFT Volume Surges

A bull flag pattern on $PENGU suggests a potential 142% upside move toward $0.081.

At the same time, Pudgy Penguins NFT trading volume has jumped 273%, fueling market speculation around the ecosystem.

Could momentum in NFTs drive the next rally for

- Reward

- like

- Comment

- Share

#Gate June Transparency Report#

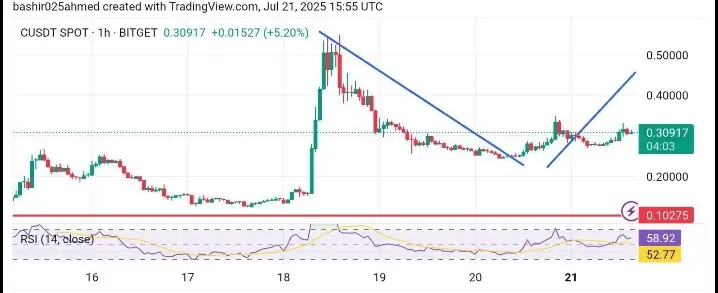

CUSDT/USDT :

$C

Chart Overview:

Exchange: getio

Timeframe: 1-hour

Current Price: $0.30917

Change: +5.20%

Price Action:

Downtrend Broken: A clear downtrend line has been broken, indicating the end of the recent bearish phase.

New Uptrend Forming: The price has formed a higher low and is currently pushing up in a new bullish channel, signaling potential upside continuation.

Key Resistance Ahead: Around the $0.35–$0.40 level, which acted as resistance in the previous rally — this will be a critical zone to watch.

Indicators:

RSI (Relative Strength Index):

Cu

CUSDT/USDT :

$C

Chart Overview:

Exchange: getio

Timeframe: 1-hour

Current Price: $0.30917

Change: +5.20%

Price Action:

Downtrend Broken: A clear downtrend line has been broken, indicating the end of the recent bearish phase.

New Uptrend Forming: The price has formed a higher low and is currently pushing up in a new bullish channel, signaling potential upside continuation.

Key Resistance Ahead: Around the $0.35–$0.40 level, which acted as resistance in the previous rally — this will be a critical zone to watch.

Indicators:

RSI (Relative Strength Index):

Cu

- Reward

- like

- Comment

- Share

$DOGE is gaining serious traction again,up 160% from its cycle low and following its classic pattern of explosive 150–400% rallies followed by steep 70% corrections. That familiar rhythm seems to be unfolding once more.

Open interest on Hyperliquid has surged to $270M, and Thumzup Media just announced plans to add Doge to a $250M treasury.

Even institutional players are starting to take notice.

This feels bigger than a typical meme coin pump,$DOGE looks poised to remind the market why it’s the original memecoin heavyweight.

Call it bold, but $1 might be a lot closer than people think.

Open interest on Hyperliquid has surged to $270M, and Thumzup Media just announced plans to add Doge to a $250M treasury.

Even institutional players are starting to take notice.

This feels bigger than a typical meme coin pump,$DOGE looks poised to remind the market why it’s the original memecoin heavyweight.

Call it bold, but $1 might be a lot closer than people think.

- Reward

- 1

- Comment

- Share