NFT Floor Prices Continue to Fluctuate: Where Is the Market Headed?

What Is an NFT Floor Price?

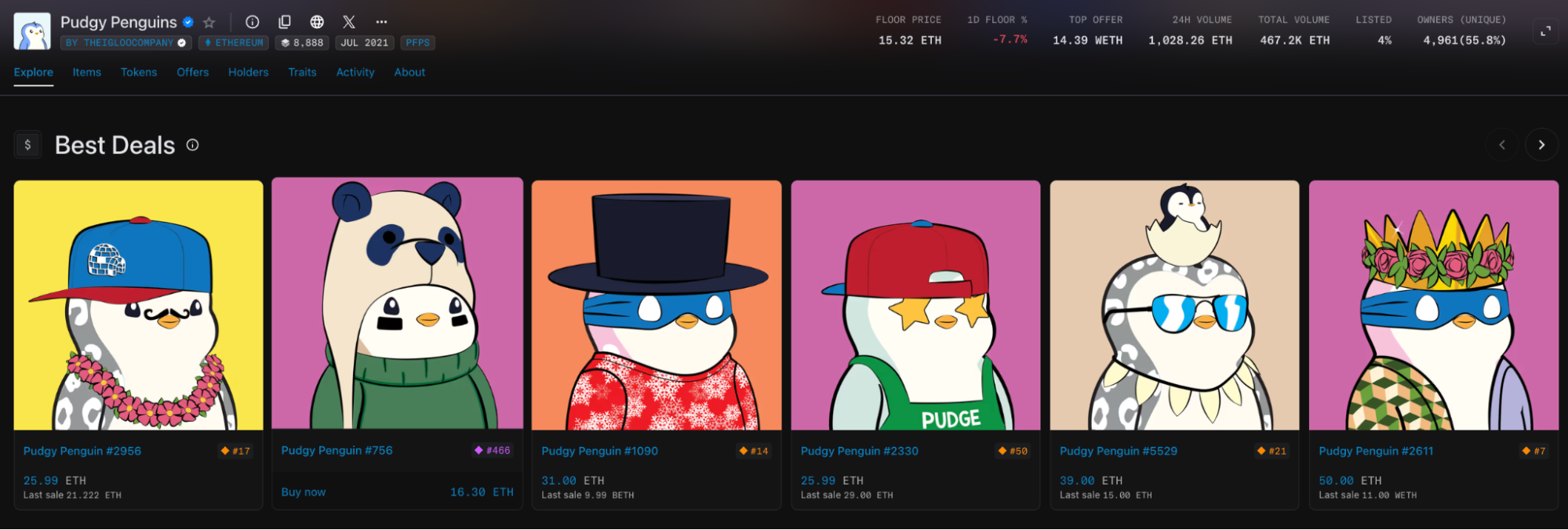

Source: https://opensea.io/collection/pudgypenguins/explore

In the NFT market, the “floor price” is the lowest price at which an NFT from a collection is listed for sale. Simply put, if you want to buy an NFT from that collection, the floor price is the minimum price you must pay.

Floor prices are a key metric on leading NFT secondary markets like OpenSea and Blur. Investors, collectors, and analysts closely track floor prices as a core reference for assessing NFT project activity and value.

The Meaning and Role of Floor Price

The floor price provides insight into a project’s market liquidity as well as the sentiment and level of recognition among its community. For example, a rapid increase in floor price may signal heightened market optimism and bullish expectations. Conversely, a sudden drop often points to selling pressure or declining project interest.

Current Floor Prices of Top NFT Projects (as of July 2025)

The current floor prices (denominated in ETH) for several major NFT collections are as follows:

- Bored Ape Yacht Club (BAYC): around 25 ETH

- Pudgy Penguins: 15.2 ETH

- Milady Maker: 5.2 ETH

- Doodles: 1.1 ETH

These figures are updated daily on major NFT marketplaces, and actual prices may vary depending on the platform. For the most recent numbers, refer to official data sources such as OpenSea and Blur.

What Drives Floor Price Volatility?

Floor price fluctuations are not random. They result from a combination of factors:

- Project progress and marketing campaigns: Events such as airdrops, feature launches, or brand collaborations often push floor prices higher.

- Overall market conditions: When the broader crypto market is bullish, enthusiasm for NFTs typically rises as well, lifting floor prices.

- Whale activity: When major holders sell their NFTs, it can drag down the floor price and trigger panic selling.

- Impact of social media: Community discussions and endorsements from key opinion leaders can spark short-term hype, moving prices up or down.

How to Evaluate an NFT’s Investment Value

In addition to floor price, new participants should consider the following indicators:

- Trading volume: High trading volume signals a liquid market where prices are better supported.

- Number of unique holders: Greater decentralization of ownership reduces concentration risk and increases project stability.

- Project roadmap and team activity: Consistent development and long-term commitment from the team and project are important considerations.

- Community engagement: Activity levels on X (formerly Twitter) and Discord offer indirect insight into project momentum and popularity.

Summary: How Should Beginners Approach Floor Price Swings?

For newcomers to NFTs, the floor price is only one of several reference points. It is advisable not to chase rapidly rising prices or sell impulsively when the floor price declines. Investors should focus on understanding the value behind each project, remain aware of market dynamics and sentiment, and approach investment decisions with a rational and well-informed mindset.

Share

Content