Omni Network: Building the Next Generation of Interoperability for Ethereum Rollups

A Blockchain Network Engineered for Modular Scalability

(Source: OmniFDN)

As Ethereum’s Layer 2 scaling strategy continues to take shape, rollup solutions have become the industry standard. Yet these rollups often function as isolated silos, making seamless interoperability a major challenge. The Omni Network seeks to eliminate the barriers between rollups, delivering true cross-chain synchronization and native interoperability. Unlike traditional bridge protocols, Omni is architected as a Layer 1 network—providing not just a message transmission channel but also a redesigned coordination and security framework. This enables developers and users to benefit from a more efficient and cohesive on-chain experience.

Security Backed by EigenLayer Integration

Omni’s security model doesn’t rely solely on its own design. Instead, it incorporates EigenLayer’s Restaked ETH model, allowing nodes to simultaneously stake ETH and OMNI tokens to participate in network consensus—a dual-layer protection approach. This architecture enhances resistance to attacks and ties Omni’s security costs directly to the Ethereum mainnet, ensuring enhanced stability and resilience.

At the protocol layer, Omni leverages CometBFT consensus (formerly known as Tendermint), together with ABCI++ and the Engine API, to achieve confirmation times measured in seconds. The platform supports delegated staking and modular client expansion, creating significant potential for future upgrades.

XMsg Protocol: High-Speed Cross-Rollup Messaging

One of Omni’s most distinctive features is its XMsg (Cross-Rollup Message) protocol standard. XMsg is more than a message transport layer—it encompasses authentication, packaging, consensus, and submission as a complete protocol suite. When a cross-chain operation is triggered on a rollup, validators generate an XBlock, which, after reaching consensus, is swiftly committed to the target rollup. Relayers then handle real-time data synchronization. This low-latency process delivers instant finality, supports pre-confirmed transactions, and is designed with future shared sequencer integration in mind. For users, this means almost no perceived blockchain waiting time.

Omni EVM and Universal Gas Marketplace

For developers, Omni offers a unified execution environment through the Omni EVM. Teams can write and deploy a smart contract once and immediately make it available across multiple rollups—dramatically reducing maintenance burdens and deployment complexity.

With the Universal Gas Marketplace, users can pay transaction fees in $OMNI or a native asset on any supported network. This eliminates the cost friction of cross-chain operations and creates a more seamless user experience.

The Four Core Functions and Value Drivers of the OMNI Token

As the ecosystem’s centerpiece, the $OMNI token is more than just a transactional medium—it fulfills several strategic roles:

- The gas payment asset for cross-rollup message processing

- The staking token for nodes and validators, enabling participation in consensus and network security

- The fee source for app deployers running DApps on Omni EVM

- An incentive for relayers, developers, and contributors, fostering a virtuous ecosystem cycle

(Source: news.omni.network)

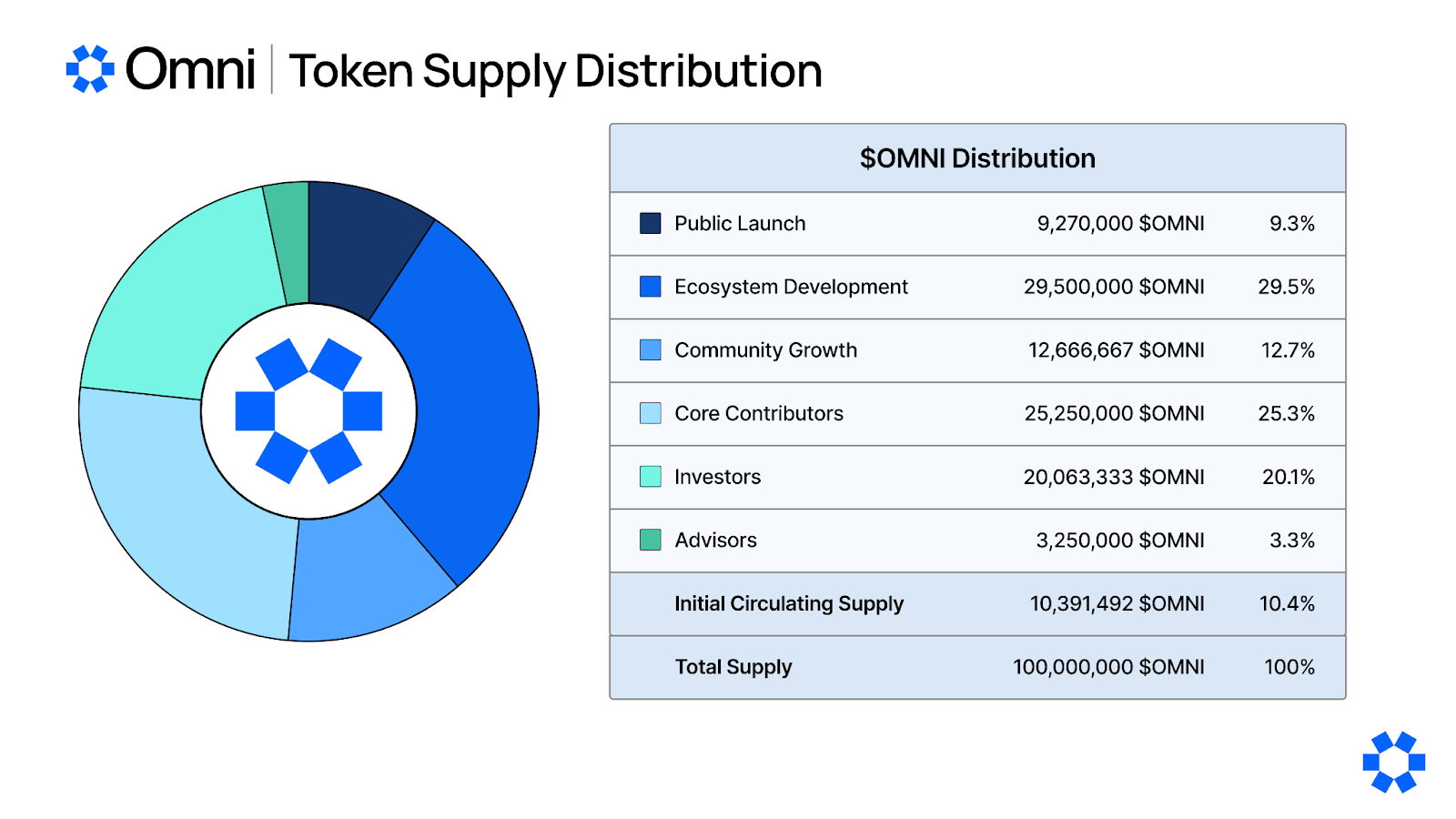

Official documentation reports OMNI’s total supply at 100 million tokens. Of this, 29.5% is allocated to ecosystem development, 25.3% to core contributors, 20.1% to investors, 12.7% to community growth, 9.3% to the public offering, and 3.3% to the advisory team. The initial circulating supply is approximately 10.4%.

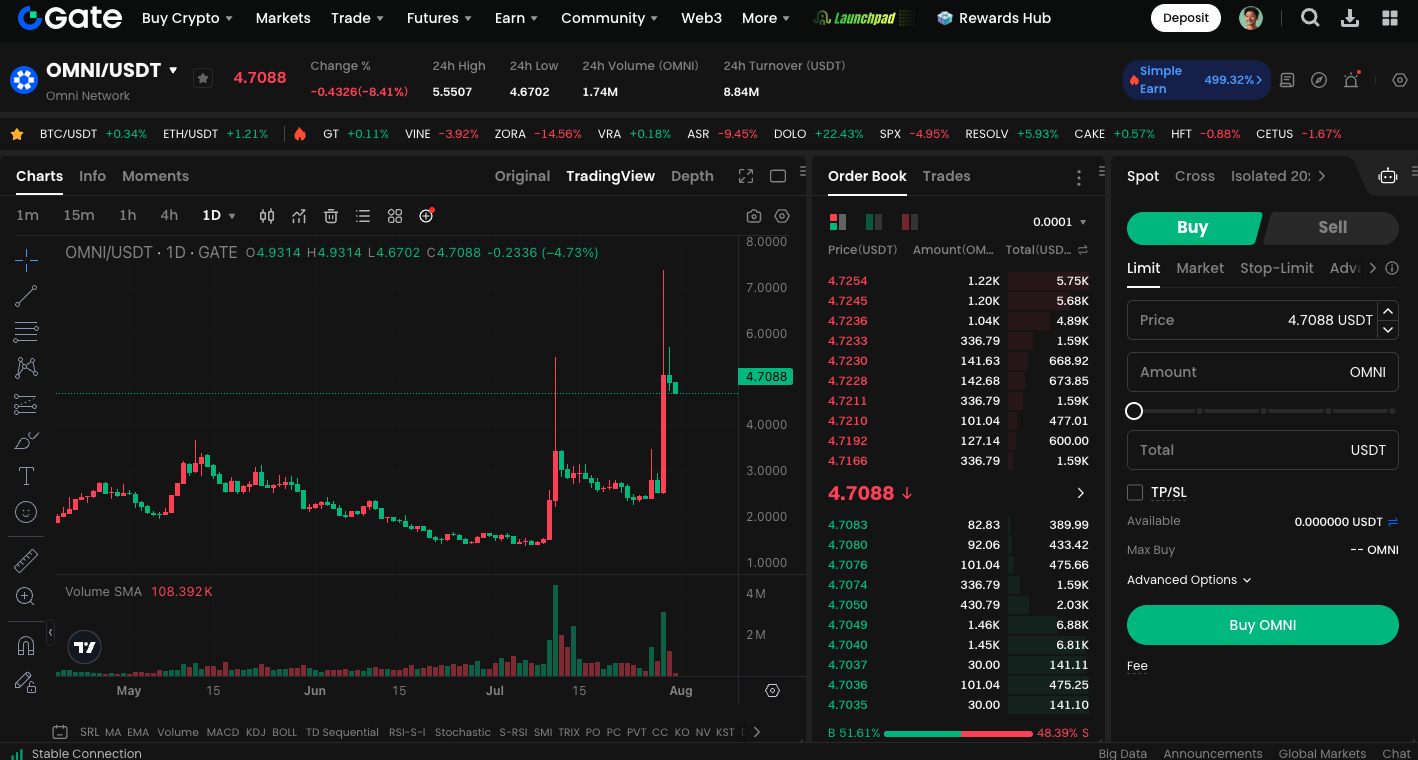

Start trading OMNI spot today: https://www.gate.com/trade/OMNI_USDT

Future Outlook and Summary

The launch of Omni Network is not just a technological breakthrough—it’s a transformation of decentralized infrastructure. By dissolving the silos between rollups, Omni enables applications to achieve true “write once, deploy everywhere” global availability. As more Layer 2 solutions, DApps, and users enter the Omni ecosystem, the network’s connectivity and value will multiply. For developers, Omni provides a multi-chain platform that is easier to deploy on; for users, it offers a smoother, more cost-effective blockchain experience.