流動性ウォーズ3.0、賄賂が市場になる

この記事では、投票エスクロー(ve)メカニズム、メタインセンティブ、Votiumなどの贈賄プラットフォーム、そしてTurtle ClubやRoycoなどの新興プロトコルが、革新的なメカニズムを通じて資本効率を最適化し、DeFiのメタガバナンス層を形作っている方法について探求します。再び収益戦争が見られると信じています。DeFiに長い間いた人なら、TVLが虚栄心の指標であることを知っています。

ハイパーコンペティティブでモジュラーなAMM、perps、および貸出プロトコルの世界では、本当に重要なのは流動性ルーティングを制御するのは誰かということです。プロトコルを所有しているのは誰かではありません。最も多くのリワードを発行しているのは誰でもありません。

しかし、誰が流動性提供者(LP)を説得して預金し、そしてTVLが安定していることを確認しますか。

そしてそこが賄賂経済の始まりです。

かつては非公式な投票買収(Curve wars、Convexなど)が、今では完全な流動性調整市場に進化し、オーダーブック、ダッシュボード、インセンティブルーティングレイヤー、そして場合によってはゲーム化された参加メカニズムを備えています。

それは、DeFiスタック全体で最も戦略的に重要なレイヤーの1つになりつつあります。

何が変わったのか:排出からメタインセンティブまで

2021-2022年、プロトコルは古い方法で流動性をブートストラップしました:

- プールを展開する

- トークンを発行する

- 収益が下がった後も、傭兵LPがいつも通り残っていることを願っています

しかし、このモデルは根本的に欠陥があります。反応的なものです。各新しいプロトコルは見えないコスト、つまり既存の資本流の機会費用と競合します。

Yield Warsの起源: Curveと投票市場の台頭

Yield Warsの概念は、2021年に始まったCurve Warsと共に具体的になり始めました。

Curve Financeのユニークなデザイン

Curveは、ユーザーがロックできる投票エスクロー(ve)トークン経済を導入しました。$CRV(Curveのネイティブトークン)を最大4年間veCRVと交換し、それによって〜が付与されました:

- Curveプールの報酬が増加しました

- ゲージウェイト(どのプールがエミッションを受け取るか)に投票するためのガバナンスパワー

これにより、排出物をめぐるメタゲームが生まれました:

- プロトコルはCurveで流動性を求めていました。

- それを得る唯一の方法は、彼らのプールに投票を集めることでした。

- それで、彼らはveCRV保有者に賄賂を贈ることで、彼らの支持を得る投票を始めました。

その後、Convex Financeが登場しました

- Convexは、veCRVのロックとユーザーからの集約された投票権を抽象化しました。

- それは「カーブキングメーカー」となり、どこに大きな影響力を持つか$CRVemissions went.

- プロジェクトは、Votiumなどのプラットフォームを介して、Convex/veCRV保有者に賄賂を贈り始めました。

レッスン#1:ゲージをコントロールする者が流動性をコントロールする。

II. メタインセンティブと賄賂市場

最初の賄賂経済

排出物を影響するための手作業が始まり、完全な市場に発展しました。

- Votiumは のOTC贿賂机关になりました$CRVemissions.

- Redacted Cartel、Warden、およびHidden Handは、この拡張をBalancer、Fraxなどの他のプロトコルに拡大するために現れました。

- プロトコルはもはや単に排出物を支払うだけではなく、資本効率を最適化するためにインセンティブを戦略的に割り当てていました。

カーブを超える拡張

- Balancerは、$veBALを通じて投票エスクロー機構を採用しました。

- Frax, @TokemakXYZ, そして他の企業も同様のシステムを統合しました。

- Aura FinanceやLlama Airforceなどのインセンティブルーティングプラットフォームは、複雑さをさらに増しており、排出物を資本調整ゲームに変えています。

レッスン#2:収量はもはやAPYについてではなく、プログラマブルなメタインセンティブについてです。

III. 収量戦争の戦い方

プロトコルがこのメタゲームで競争する方法はこちらです:

- 流動性集約: コンベックスのようなラッパーを介した影響の集約(例: @AuraFinanceBalancer) のため。

- 贈賄キャンペーン:必要なところに排出物を引き付けるための継続的な賄賂用予算。

- ゲーム理論&トークン経済学:トークンをロックして長期的な調整を行う(例:veモデル)。

- コミュニティインセンティブ: NFT、抽選、またはボーナスエアドロップを通じた投票のゲーム化。

今日、プロトコルは、@turtleclubhouseおよび@roycoprotocoldirectsその流動性:単純に発行するのではなく、需要の信号に基づいてLPにインセンティブをオークションで提供します。

基本的には、「あなたが流動性をもたらすなら、私たちはインセンティブをそこに振り分けます。」

これにより、二次効果が解除されます。プロトコルはもはや流動性を徒力できず、代わりにそれを調整します。

タートルクラブ

誰も話していないが、静かに最も効果的な賄賂市場の1つです。彼らのプールはしばしばパートナーシップに組み込まれており、TVLは580百万ドルを超えています。デュアルトークンの発行、重み付けされた賄賂、驚くほど粘着力のあるLPベースがあります。

彼らのモデルは公正な価値再分配を重視しており、つまり、排出量は投票とリアルタイムの資本速度メトリクスによって誘導されます。

それはよりスマートなフライホイールです:LPは、単なるサイズではなく、資本の効果に応じて報酬を得ます。効率が奨励されるのは初めてです。

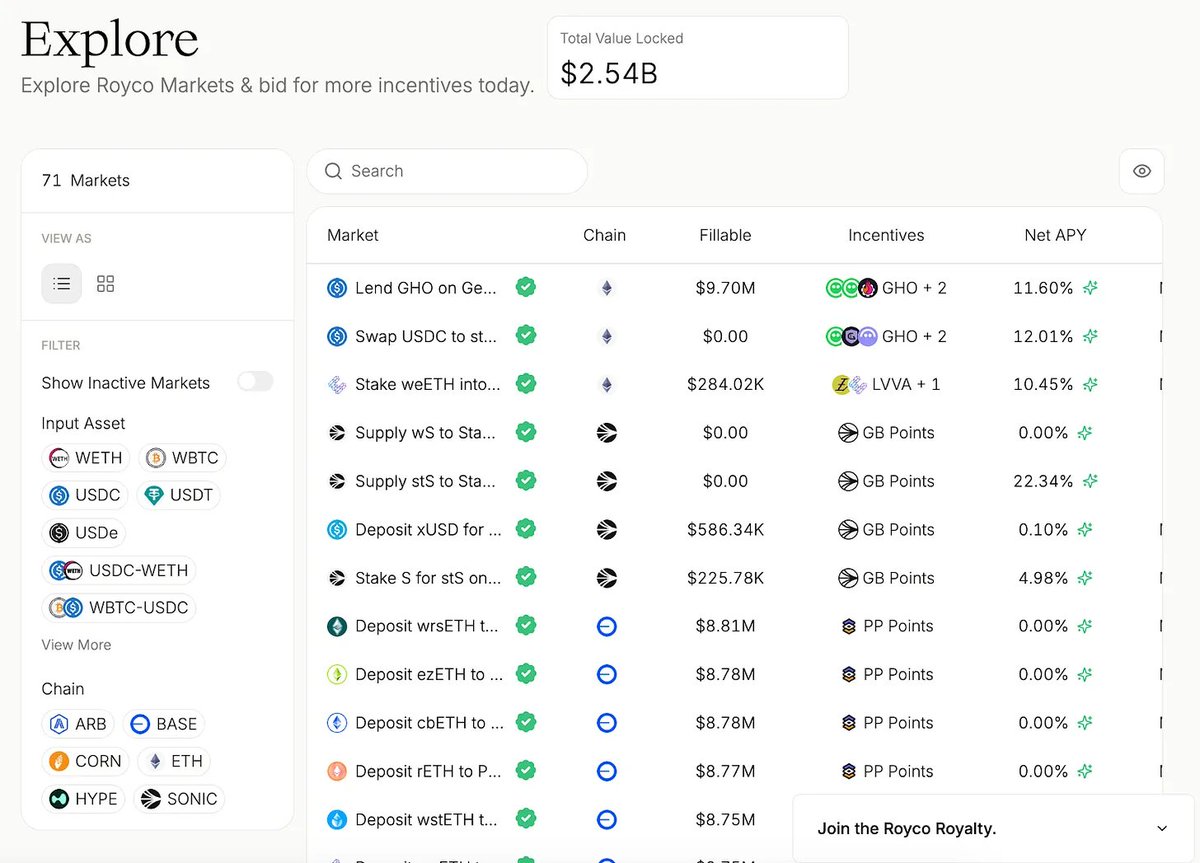

Royco

1か月で、TVLは26億ドルを超え、月々267,000%の急激な成長を遂げました。

それらの一部は「ポイントによる」資本である一方、重要なのはその背後にあるインフラストラクチャです。

- Roycoは流動性嗜好のオーダーブックです。

- プロトコルは報酬をただ捨てて期待することはできません。彼らはリクエストを投稿し、LPが資本を投入するかどうかを決定し、その後調整はマーケットプレイスとなります。

これが、この物語をただの収益ゲーム以上のものにしている理由です:

- これらのマーケットプレイスはDeFiのメタガバナンス層となっています。

- @HiddenHandFialreadyは、主要なプロトコルを通じて35億ドル以上の累積賄賂を流動させています。@VelodromeFiそして@Balancer.

- RoycoとTurtle Clubは今、排出物が効果的な場所を形作っています。

流動性調整市場のメカニズム

- 贈賄は市場シグナル

- Turtle Clubなどのプロジェクトを利用すると、LPはインセンティブがどこに流れているかを見ることができ、リアルタイムのメトリクスに基づいて意思決定を行い、キャピタルサイズだけでなくキャピタル効率に基づいて報酬を受け取ることができます。

- 流動性要求(RfL)としての注文簿

- Roycoなどのプロジェクトは、プロトコルが注文のような流動性ニーズをマーケットプレイスにリストアップできるようにし、LPは期待されるリターンに基づいてそれらを埋めます。

- これは一方通行の賄賂ではなく、両側からの調整ゲームとなります。

もし流動性がどこに行くかを決めるなら、次の市場サイクルで誰が生き残るかに影響を与えます。

免責事項:

- この記事は[から転載されましたarndxt]. すべての著作権は元の作者に帰属します [@arndxt_xo]. If there are objections to this reprint, please contact the Gate Learnチーム、そして彼らは迅速に対処します。

- 責任の免責事項:この記事で表現されている意見は、著者個人のものであり、投資アドバイスを構成するものではありません。

- 他の言語への記事の翻訳は、Gate Learnチームによって行われます。特に言及されていない限り、翻訳された記事のコピー、配布、または盗用は禁止されています。